This post will explain my path into borrowing money, investing in Bitcoin, Ethereum, and other crypto currencies and the lessons I learned from the mistakes along the way. I will also explain briefly the different investment opportunities that I believe we should all investigate.

I have written this post as it is something that a lot of people have asked me about and have been interested in.

Disclaimer – I am not an expert and I am not plugging anything. I am simply telling my story and then recommending that people take time to look into investment opportunities.

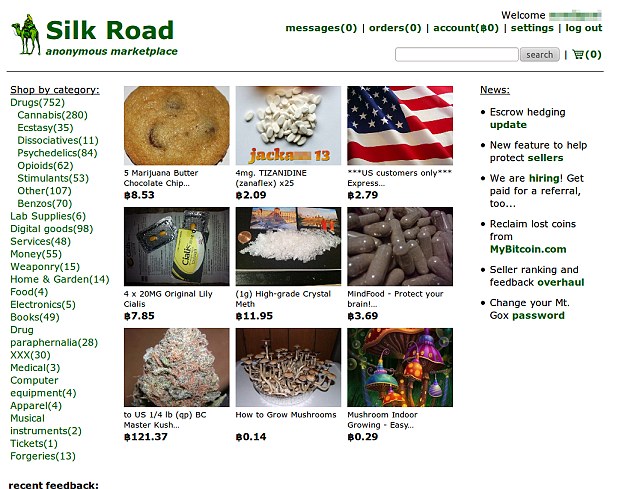

The Dark/Deep Web

In 2010 I discovered what the Dark Web was and my mind was instantly blown. I became quickly obsessed with it and spent time trawling through it, learning about bitcoin, about Tor, about the anonymity and also of course the crazy things that were offered for sale.

-Drugs

-Weapons

-Assasins for $20000 , (3 rules for having someone assasinated):

- Noone under 18

- Noone famous

- No political figures

-Child porn

-Live humans for experiments

-Passports

-Visas

-ANYTHING that you can possibly think of.

Initial Investment in Bitcoin

I knew that this was going to be huge and so only told my closest friends. Meanwhile I started borrowing money off rich friends to buy Bitcoins, wait, and then sell them for a higher price. This was making me a nice little income until the regulations on buying bitcoins become much stricter and I could no longer legally purchase them. I then started to buy them off bitcoin, “dealers”, which involved building up a relationship with them, sending the money to their bank account and then nervously waiting for bitcoins to arrive in your “wallet”.

This was going great until my bitcoin “dealer” had his bank account frozen under suspicion of money laundering, and so the 800 that I had borrowed off a friend was lost, and I was 15/16 years old and in 800 of DEBT and with no job. I then had a decision to make, cut my losses and get a job and slowly pay back the money, or double up and risk it again.

Double or Quits

Of course I decided to risk it.

I borrowed another 800 off a different friend and started the process again, this time with some well needed skepticism and caution. I remember buying about 250 bitcoins, and then within a short space of time they had more than tripled in price. I was over the moon, I had made money to pay back both friends and leave me with a nice profit. I then had another decision to make – quit while I was ahead or double up and risk it again.

I decided that I had dabbled enough in this avenue to get a taste for it but that I was too young and naive to get involved. I knew it was going to keep growing and keep growing but I completely stopped using the dark web and investigating bitcoin. At Christmas 2018 those final 250 bitcoins I bought would have been worth $5 million. Do I regret it? No.

I fully believe that the decision to stop was one of the wisest decisions I have ever made. Making so much money at a young age when I was a wreckless, naive, addict would have 100% led me to an early grave, and even at the time I was aware of this.

What I Learned

Lesson 1 – Wait until I can use my own money or a banks´ money to invest.

Lesson 2 – If you have an addiciton or a vice then STAY AWAY from easy cash. More money creates more problems

The Ethereum Project

In March 2017 my curiosity with Crypto-currency was sparked again whilst sitting at work chatting on Whatsapp to a friend.

He told me about Ethereum, a new project in the same branch of technologies as Bitcoin. My obsession with the Crypto world was re-started.

I am not going to explain exactly what Ethereum is but I would recommend reading at least a bit about it, as it is really exciting. You can click here to go to the Ethereum Project website.

I quickly did as much research as possible and sensing that this was going to be even bigger than Bitcoin, I used all my savings – which at the time was not a lot, as I had just started a new job and had only just started saving – and bought as many Ethereum as I could. I also ordered a credit card and maxed that out buying more. The next year was spent fixated with watching the price go up and up and up. It became an obsession to the point where I would be sitting watching the graphs fluctuate up and down for hours on end.

The Gambling / Addict Mentality

It is so insane looking back at it and the Gambler/addict mentality when you are watching potential profits fall. Over Christmas 2018 the price shot up so quickly that I unwillingly sold all of my Ethereum at prices that I had originally set as a sort of “joke”. I had sold them overnight for 20x what I had bought them for – HOWEVER, I was DEVASTATED. I watched the price continue rising and rising so that my 20x could have been 30x had I not have sold. In my head this was a loss of 10x, and not a MASSIVE gain.

I did what almost every new investor in this situation does: I panicked and bought back my investment at a higher price, (with the hope to sell them even higher).

I then watched as it crashed down and my “net worth” fell. All of this felt like I was permanently losing money – when in reality it was all pure profit as I had already taken out my original investment plus more.

Re-Investment

Looking back on it I stand by my decision to re-invest, as my logic was that, although I had made a lot of money, the sum of money that I had was not a life changing amount of money, and so I was willing to risk it all for the chance to make enough money to buy a property outright – or set myself up for life.

I still have half of my Ethereum and now it no longer occupies my life following the ups and downs of the daily charts. I sold half for an amount I was happy enough with and left the other half just to do their thing. If Ethereum crashes majorly again I will BUY BUY BUY, and if it rises again I will sell what I have left.

More Lessons

Lesson 3 – Withdraw your initial investment so that you can then set a target for what profit you want to reach.

Lesson 4 – Do NOT sit and obsessively watch the daily charts. Do your research, make a decision about how you think the market will act, and then set your Buy and Sell goals and walk away.

This story doesnt have an end yet and it is one project that I am happy to just let run its course.

Starting to Invest

I thoroughly believe that everyone should use their spare cash for investment. Keeping money in banks is the biggest waste of time. There are a whole range of things that you can invest in such as Premium Bonds, the Stocks/shares, Crypto Currencies and also start up companies – to name but a few.

Below is the 3 options I have mentioned in order of risk.

Premium Bonds

Premium Bonds are extremely safe – Basically putting your money into a pot which then gives you access to what is effectively a raffle where, you can win cash prizes. This is a government scheme and is extremely safe. Any earnings from this are tax exempt and you can withdraw your money whenever you choose. For more information on Premium Bonds click here.

To go to the National Savings and Investment website to purchase premium bonds click on the link.

Stocks and Shares

This effectively buying a percentage of a company (share), or buying various different financial products in the hope that they will rise in price. This is more risky and very addictive. If you are prone to gambling I would not recommend it – however, with patience, research, common sense and self-control this is can be an extremely effective way to make a side income. There are many different platforms for doing this with one of the easiest being www.etoro.com

Start Up Companies

This can be done in many ways, even before the company has launched via platforms such as Kickstarter. And also when companies launch their Initial Public Offering – which is when they first sell their “shares”. For me this is the most exciting of the options. The risk is very high but the rewards can be incredible – (imagine having invested in Amazon, Apple, Microsoft, Uber, etc. right at the beginning). Projects like this can end up providing returns of 100x + on your investment. So although the risk is high, there is no need to put a huge amount of money into the projects. It is also exciting to be part of a project and watch it develop. The irritating thing is that the projects that are best on paper, (have the best teams, idea etc), are often not the ones that succeed. For this you really need to investigate well and also have some luck. They are also by no means a quick return.

Via the Ethereum project many start ups have launched their own, “Crypto Currency”, as a way of raising money for their project. A lot of these are scams but a lot of great projects are underway because of this.

For more information on Investing in Start-ups read this page from Forbes

Crypto-Currencies

By far the most volatile thing to invest in. There is a huge amount of money to be made but it can be lost in the blink of an eye – extreme caution when pursuing this. Only invest money you are willing to lose.

The best platforms for investing in Crypto Currencies are www.coinbase.com for Bitcoin and Ethereum and then www.bittrex.com for all the other Crypto Currencies.

I have purposely been quite vague about the different methods of investment as I want people to do their own research before making a decision.

As always I welcome comments, critiscism, questions and suggestions!!

Leave a Reply